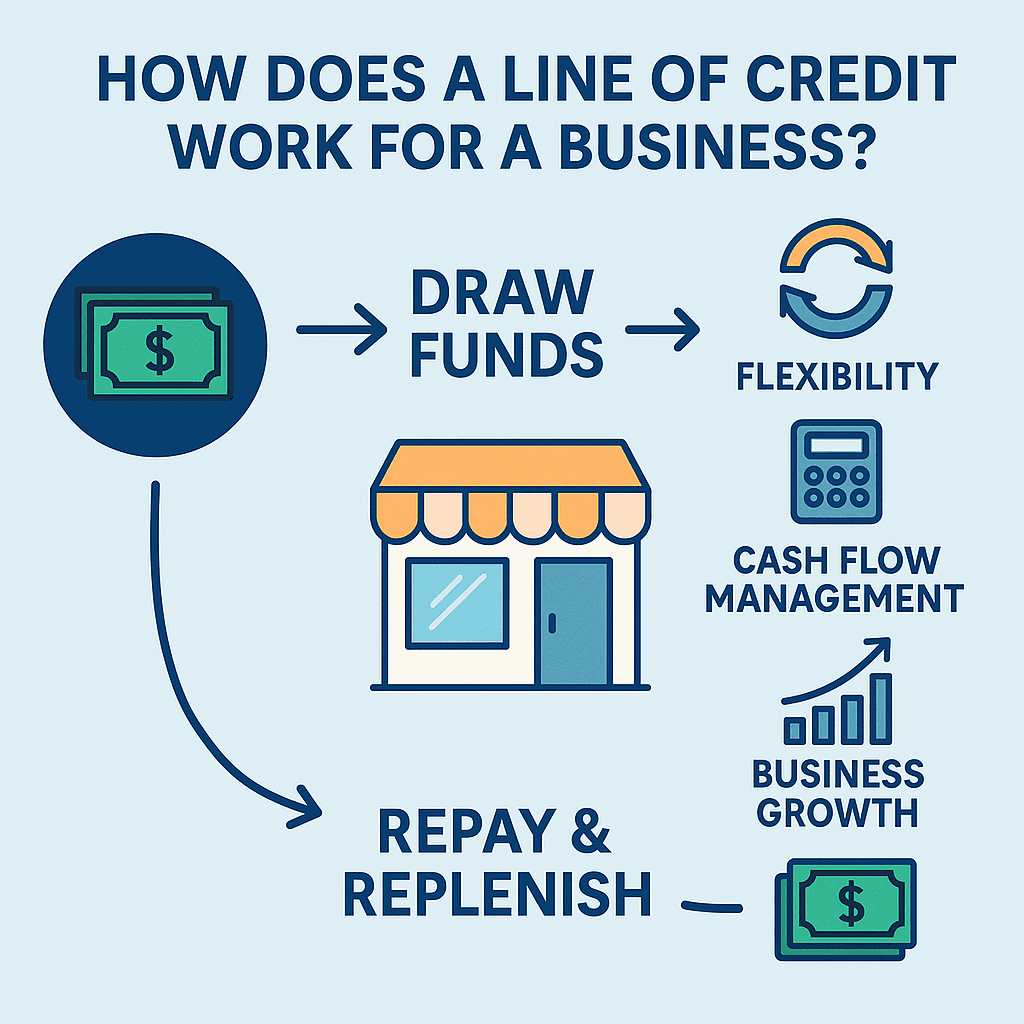

In the ever-evolving landscape of business finance, flexibility is paramount. A business line of credit offers that adaptability, allowing businesses to access funds as needed, manage cash flow, and seize growth opportunities without the constraints of traditional loans.

What Is a Business Line of Credit?

A business line of credit is a revolving loan that provides businesses with access to a predetermined amount of capital. Unlike a traditional term loan, where you receive a lump sum upfront, a line of credit allows you to draw funds as needed, up to your credit limit. You only pay interest on the amount you use, not the entire credit line.

How Does It Work?

-

Approval and Credit Limit: Once approved, you’re granted a credit limit based on factors like your business’s revenue, credit score, and financial history.

-

Accessing Funds: You can draw funds at any time, using methods like checks, business credit cards, or transfers to your business account.

-

Repayment: As you repay the borrowed amount, your available credit replenishes, allowing you to borrow again as needed.

-

Interest Charges: Interest is typically charged only on the amount you’ve drawn, not the total credit limit.

Secured vs. Unsecured Lines of Credit

-

Secured Line of Credit: Requires collateral, such as inventory or accounts receivable. Often offers higher credit limits and lower interest rates.

-

Unsecured Line of Credit: Doesn’t require collateral but may have stricter approval criteria and higher interest rates.

Benefits of a Business Line of Credit

-

Flexibility: Draw funds as needed for various business expenses.

-

Cash Flow Management: Ideal for covering short-term gaps in cash flow.

-

Interest Savings: Pay interest only on the amount you use.

-

Reusability: As you repay, funds become available again without reapplying.

Is It Right for Your Business?

A business line of credit is suitable for businesses that:

-

Experience seasonal fluctuations in revenue.

-

Need to manage unexpected expenses.

-

Want a safety net for cash flow gaps.

-

Seek flexibility in financing without committing to a lump-sum loan.

How Business Loan Warrior Can Help

At Business Loan Warrior, we specialize in connecting businesses with the right financing solutions. Our platform offers:

-

Personalized Matches: We assess your business needs to connect you with lenders offering suitable lines of credit.

-

Streamlined Application: Our user-friendly platform simplifies the application process.

-

Expert Guidance: Our team provides insights and support throughout your financing journey.