Securing funding can make or break a small business — and for many entrepreneurs, an SBA loan is one of the most powerful tools available. But getting an SBA loan isn’t always straightforward. Understanding how the process works can save you time, stress, and even help you get approved faster.

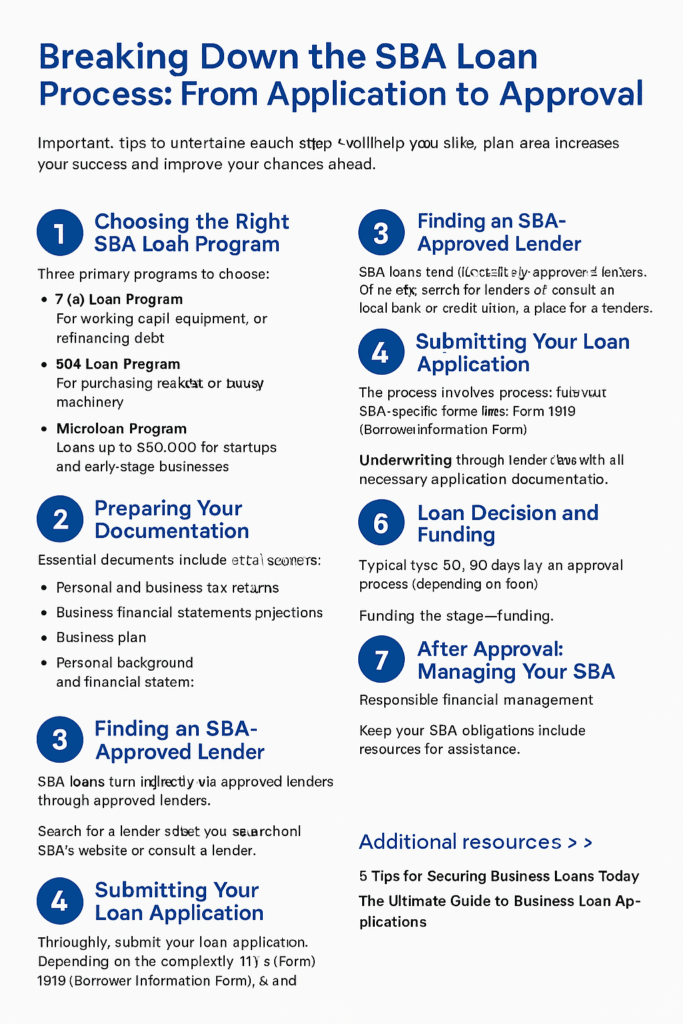

In this guide, we’ll break down the SBA loan process step-by-step so you know what to expect from the moment you begin your application to when funds are disbursed. Whether you’re a startup or an established business, this is your roadmap to navigating the world of SBA small business loans.

What Is an SBA Loan?

An SBA loan is not issued directly by the Small Business Administration (SBA). Instead, it is issued by a partner lender (like a bank or credit union) and backed by the SBA. This guarantee reduces the lender’s risk, allowing more small businesses to qualify for financing.

Most common SBA loan programs include:

- SBA 7(a) Loan – For general working capital, equipment, and more.

- SBA 504 Loan – For purchasing real estate and large equipment.

- SBA Microloan – For loans up to $50,000, often used by startups or underserved businesses

Step 1: Determine If You Qualify

Before applying, make sure your business meets SBA eligibility requirements:

- Operates for profit in the U.S.

- Meets SBA’s size standards

- Has invested equity

- Exhausted other financial options

- Has a sound business purpose

You’ll also want to check your personal and business credit scores, as most lenders look for a credit score of 650 or higher.

Step 2: Choose the Right SBA Loan Program

Not all SBA loans serve the same purpose. Here’s a quick comparison:

| Loan Type | Use Case | Max Amount | Term |

|---|---|---|---|

| 7(a) Loan | Working capital, debt refinance, equipment | $5 million | Up to 25 years |

| 504 Loan | Real estate, major equipment | $5.5 million | 10–25 years |

| Microloan | Startup expenses, small equipment | $50,000 | Up to 6 years |

Choose the option that aligns with your business goals and capital needs.

Step 3: Gather the Required Documents

The SBA loan application process requires documentation that proves your business’s financial health and legitimacy. Here’s what you’ll typically need:

- Business plan

- 2–3 years of business tax returns

- Year-to-date profit and loss statement

- Balance sheet

- Personal and business credit reports

- Personal and business tax returns

- Debt schedule

- Ownership and legal documents

Tip: Organizing these documents ahead of time helps speed up the process considerably.

Step 4: Submit Your SBA Loan Application

You can apply through any SBA-approved lender. Some lenders have dedicated SBA departments that can walk you through the steps.

Key components of the application:

- SBA Form 1919 (Borrower Information Form)

- SBA Form 413 (Personal Financial Statement)

- Loan application with business and personal financial statements

Pro Tip: Want to make sure your application stands out? Check out our Ultimate Guide to Business Loan Applications for insider tips.

Step 5: Underwriting and Review

After your application is submitted, the lender will begin underwriting — a process that includes verifying your information, analyzing creditworthiness, and assessing repayment ability.

Average time for underwriting: 1–3 weeks

Step 6: SBA Review and Final Approval

Once the lender completes underwriting, the file is submitted to the SBA for final approval. SBA reviews typically take 5 to 10 business days, but this can vary.

Step 7: Loan Closing and Funding

After SBA approval, you’ll sign closing documents. The lender will then disburse the funds, either as a lump sum or based on milestones.

Timeline from application to funding: 30 to 90 days

Tips to Speed Up SBA Loan Processing

- Be responsive to lender requests

- Organize financials in advance

- Work with experienced lenders

- Provide collateral, if possible

For more tips, see our blog: 5 Tips for Securing Business Loans Today

Conclusion: Is an SBA Loan Right for You?

The SBA loan process can feel overwhelming — but with the right preparation and understanding, it’s a smart and affordable way to fund your business. From startup expenses to real estate purchases, SBA loans offer flexibility and support that traditional loans often don’t.

Need help with your SBA loan application or looking for faster funding? At Business Loan Warrior, we help you compare SBA options and find the best funding for your business goals.