For companies with growing revenue

Equipment Financing Solutions

Whether you’re a startup outfitting your first office or an established company scaling up operations, having the right equipment is essential. But paying upfront isn’t always practical — and that’s where equipment financing comes in. As a leading equipment financing company, we offer flexible, tailored funding options that help businesses across industries acquire the machinery and tools they need to thrive.

Loan Amount

$50,000 – $5,00,0000

Loan Term

1 – 5 Years

Receive Funds

As soon as 24 hours

Interest Rate

As low as 7% Annually

What is Equipment Financing?

Equipment financing for business allows companies to purchase or lease equipment without depleting cash reserves. Instead of a hefty upfront payment, you pay in manageable installments, keeping your working capital free for other critical needs like payroll, marketing, or inventory.

Our solutions are designed to support your business through different stages, offering reliable equipment lending options whether you’re upgrading technology, expanding production, or replacing outdated machinery.

How Equipment Financing works

Equipment financing for business is a loan or lease that allows companies to acquire the machinery or tools they need without making a large upfront payment. Here’s how it typically works:

Application – Your business submits an application for equipment funding, outlining your financials and the type of equipment needed.

Approval – The equipment financing company reviews your application. If your business qualifies, they approve the funding.

Funding – Once approved, you receive the funds to purchase or lease the required equipment.

Use of Equipment – The equipment is used to support daily operations and promote business growth.

Repayment – You repay the loan or lease in fixed installments over time, often with interest.

This approach provides businesses with a practical way to secure essential tools while preserving cash flow. Whether you’re looking for commercial equipment financing, small business equipment financing, or IT equipment financing, this option offers flexibility and long-term value.

Minimum Requirements For A Equipment Financing

Meeting the following requirements can help increase your chances of securing funding from our lending partners. Failing to meet these qualifications may make it difficult to qualify for a loan.

CREDIT SCORE

650 or higher

MONTHLY REVENUE

$50,000+

TIME IN BUSINESS

6 Months

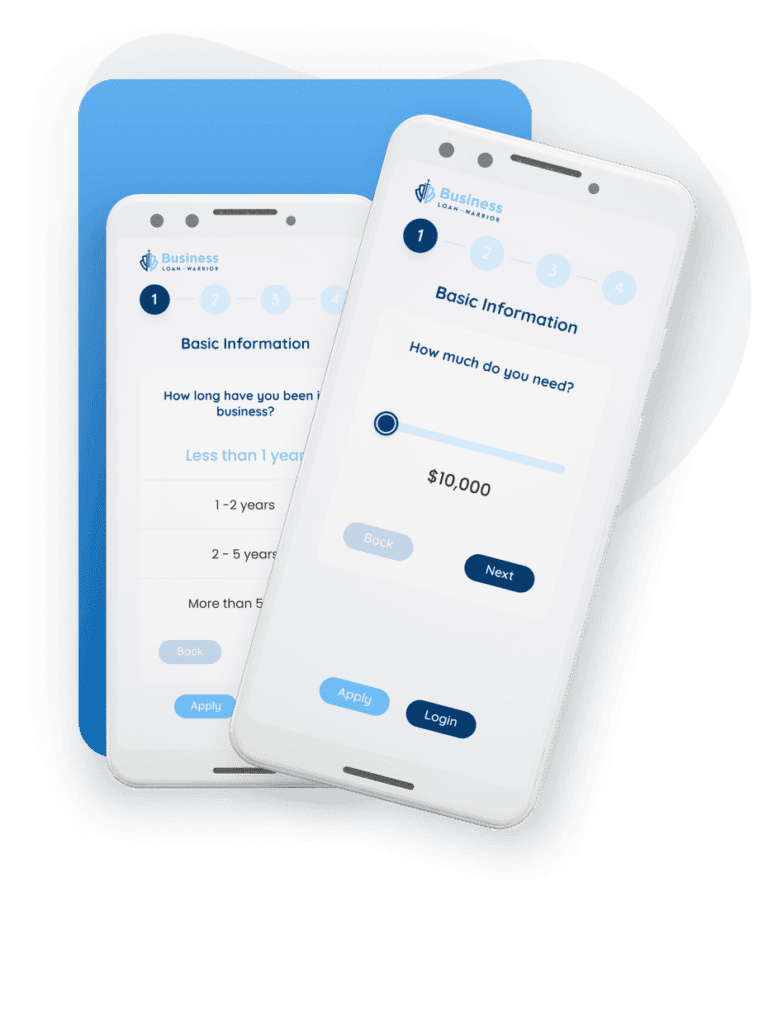

How To Apply For a Equipment Financing

At Business Loan Warrior, applying for business equipment financing is a simple and straightforward process. Here are the steps to follow:

Visit Our Website

Visit the Business Business Loan Warrior website and click on the “Apply Now” button

Fill out the 2-minute online application.

We work with a network of over 100 lenders to provide you with a range of loan options. With one-simple application, receive up to 5 loan offers, with no impact on your credit.

Get funded.

Once you’re approved, you’ll be able to access your capital in as little as 24 hours.

Testimonials

What our customer saying about us

"Business Loan Warrior made the process of getting a loan for my startup so easy. The team was incredibly responsive and helpful, and they provided me with a range of options to choose from. With their guidance, I was able to find the perfect loan for my needs, and I'm confident that I made the right choice. I would definitely recommend Business Loan Warrior to anyone looking for financing."

David."I was hesitant to apply for a loan, but Business Loan Warrior put my mind at ease. Their team was so friendly and professional, and they took the time to understand my business and my needs. They were able to match me with a lender that offered competitive rates, and the entire process was quick and painless. Thanks to Business Loan Warrior, I was able to get the funding I needed to take my business to the next level."

Maria G.Equipment financing can help your business in several ways, such as improving cash flow, preserving cash reserves, and providing access to the latest equipment to help your business stay competitive.

Equipment financing can be used to purchase a wide range of equipment, including machinery, vehicles, technology, and more. Some lenders may have restrictions on the types of equipment they finance, so it’s important to check with your lender to see what equipment is eligible.

To qualify for equipment financing with Business Loan Warrior, you will need to meet certain criteria, such as a minimum credit score, a certain number of years in business, proof of income and revenue, a down payment, and collateral. Our team of loan experts can help guide you through the process and find a financing solution that fits your needs.

The time it takes to get approved for equipment financing with Business Loan Warrior can vary depending on your business’s financial situation and the amount of the loan. However, our streamlined application process and quick turnaround time can help you get the funds you need to purchase equipment quickly and efficiently.

Business Loan Warrior is dedicated to providing personalized service and customized financing solutions to meet the unique needs of each business we work with. Our team of experienced loan experts can help guide you through the application process and find a financing solution that fits your budget and goals. Plus, our quick turnaround time means you can get the funds you need to purchase equipment and grow your business faster.

"I had been searching for a loan to expand my small business, but I was struggling to find a lender that would work with me. Then I found Business Loan Warrior. Their team was incredibly helpful and supportive throughout the entire application process, and they were able to match me with a lender that offered great terms. I highly recommend Business Loan Warrior to any business owner in need of financing."

John S. Small Business Owner